Can You Calculate How Much Love Costs?

It is an interesting question really; do you think that you could do it? Putting a price on love is impossible, the perfect relationship is priceless. However, how much does it cost to be in a relationship?

It is an interesting question really; do you think that you could do it? Putting a price on love is impossible, the perfect relationship is priceless. However, how much does it cost to be in a relationship?

There are many people that will have never have thought about this before. They will; not have considered that a relationship will cost any money at all, but in fact research has been done to show that it can cost a lot. Rate Supermarket looked at the cost of dates, holidays, engagement and wedding over a two year period and calculated that on average the total would be over $43,000.

This may seem like a lot of money and you may wonder whether it is actually worth it, with trying to keep another person happy and no guarantee that will end happily. However, kidding aside, it just shows how important it is to put away money from a young age. If you have to pay this out just for two years of a relationship, imagine what life will cost once there are children to support and a home to pay for. It is therefore worth thinking about getting some savings together really early.

If you want to be able to afford a mortgage or even just rent a really nice property, then you will need significantly more money than this. Therefore you will need to start saving up.

It can be difficult saving. Especially if you do not know what sort of future is ahead of you. However, there is a secure feeling in knowing that you have some money put away. Whether you will use it on a relationship or other things in the future does not really matter. Just knowing that it is there can really give you a good feeling. It can give peace of mind and then if you do have a bill or emergency where you need money. It will be there to help you. When you do start a relationship, then you can treat your partner to some really nice things or you can continue to save and get some things in the future. Obviously what you do with it, is up to you but unless you have it in the first place, you will not need to be making this decision.

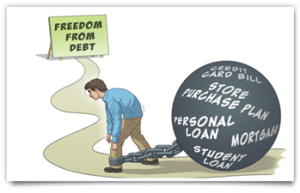

Financial planning can sound like something that pensioners need to do, but actually the earlier we can get in to good spending and saving habits, the better. We will be much better off in the future if we can get used to be financially clever when we are younger and knowing the best way to handle our money. Then we will know how to use it to our best advantage when we are older and will be more likely to have more of it, when it comes to having to pay for the important things in life such as mortgages, weddings and children. It can seem a daunting prospect but learning financial lessons young can save a lot of hassle when you are older.