Bad Credit Now Can’t Take Away All Your Options

In these days of a worsening economy and increasing job layoffs, sliding down the slippery slope to bad credit is no longer only associated with careless, undisciplined spenders. Careful, conscientious people are caught in situations they never choose which have led them to bad credit. We don’t have to look far to see the casualties of bad credit and those who are labelled as such, often feel mentally paralysed.

In these days of a worsening economy and increasing job layoffs, sliding down the slippery slope to bad credit is no longer only associated with careless, undisciplined spenders. Careful, conscientious people are caught in situations they never choose which have led them to bad credit. We don’t have to look far to see the casualties of bad credit and those who are labelled as such, often feel mentally paralysed.

The Theft of Your Options

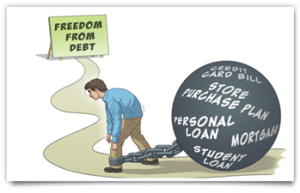

Perhaps the most confining aspect of bad credit is its stifling ability to rob one of life’s most precious commodities: options. Why are options so critical? Because without them, you are driven by the whims of others: others’ schedules, programmes, interest rates, jobs, cars and on and on it goes.

Veggie Burger or Juicy Steak

An option can, for example, give you the choice between a healthy veggie burger and a scrumptious, juicy, thick steak. For the health conscious, the choice may be easy. For the carnivore reading my words, walking away from the scrumptious steak is tantamount to a mortal sin. But the option to choose gives you power; power to rule over what you want and need in daily life.

Pull Up!

The downward spiral of bad credit does remove many options and although life’s emergencies or less than optimal financial choices may have slapped the “bad credit” label on you, although costly, it doesn’t mean financial death. Quite the opposite – the vast majority of us have families and responsibilities to take care of and have no wish to fail in doing so. It’s time to rise above the muck and wake up to your options, one of which may be a bad credit short term loan.

Experts Praise Options

The discipline of assessing your financial position is crucial to recovery with bad credit. Experts recommend honest, careful listing of all your debts, large and small. The step of making a budget cannot be overlooked as you list your income and how you spend your monies each month, both of which give you a realistic picture of next steps you can take in your plan to move ahead.

Now fast forward five years – every decision you make today will either put you in a better or worse financial situation then. The option of leveraging cash today with what is sometimes called a bad credit payday loan may give you some breathing room financially for a short term in order to move forward tomorrow.

Freedom of Choice

Back to the veggie burger and steak illustration, which would YOU choose? Say you were assigned one while your neighbour in the table next to you got his or her choice – feeling a bit cheated?

The truth is that, with your finances, you absolutely must be in control of your choices. These choices include discipline, hard work, seeking out counsel if needed. You may need the option of immediate cash to give you financial options in the near future. Your bad credit doesn’t need to keep you from a short term loan. You can use these monies for any purpose you desire, they are generally given with instant approval and with payday right around the corner, you can pay them right away.

Always read carefully the terms of any loan and experts caution against using short term bad credit payday loans to continue bad spending habits.

Gift of Time

The ability to pause and examine your options and best next financial steps require time to think; time to assess what your challenges are and how you will face them head on. Now your less than perfect credit doesn’t call the shots, you do. Your choice of tools in gaining more time may be best served with a short term loan before your next payday. Here’s to your options!

Freelance writer Sarah Fox sees options as key to freedom in all of life. She notes that bad credit payday loans are gaining increasing attention as option-based planning gains popularity.