Top Tips to Getting on Top of Debt

It is almost inevitable that we’ll run into debt at some point in our life; whether that’s on credit cards, loans, overdrafts or any other item of credit. Debt shouldn’t be feared; in fact without it we’d never be able to establish a good credit score.

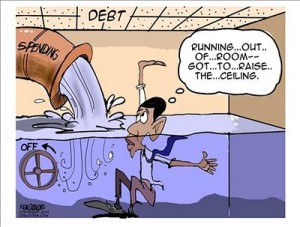

The only time debt can become a problem is if you let it run out of control. For example, having large outstanding balances on credit or store cards while attempting to repay car loans and arranged overdrafts is likely to cause financial problems. This is why it is important that you take action as soon as you feel your debt is becoming unmanageable.

Face the facts

Often the core reason people get into heavy debt is because they’ve buried their head in the sand and continued to spend in the same way they always have. Your first step to financial freedom is facing the facts and subsequently working on a recovery plan. Naturally, you will have to make some cutbacks, meaning for the foreseeable future luxuries will be out of the question.

Draw up a spending plan

Drawing up a budget that breaks down all sources of income and outgoings will help you to understand your current financial situation. It will also highlight areas where you’ve been overspending thus giving you a chance to make cutbacks and increase your level of disposable income.

Set Financial Goals

Having drawn up a budget you can then start to set some financial goals. We always recommend setting a list two different types of goals; short-term and long-term. Your short term goals should include things like clearing all loan arrears, clearing your overdraft or paying off the outstand balance on a credit or store card. Naturally your long term goal should be getting debt free; however it’s important that you set a date of when you want to be debt free by. By being both ambitious and realistic with your timescales you will ensure you’re never short of motivation.

Frequently reassess your situation

Throughout your journey to financial freedom it is likely that your finances will be consistently changing, this is why it is important that you continually refresh your budget. For example, if you pay off a credit card balance this is likely to leave you with some extra cash each month that you can churn back into something else e.g. overdrafts or loan repayments.

Ensuring that your budget is always fresh should also give you some idea of your progress. Initially it may be tough, but sticking to your budget is the best way to financial freedom. In order to motivate yourself you could offer incentives or rewards in conjunction with your financial goals. For example; treat yourself to a meal out when you pay off your first item of credit.

Seek Help

If at any point you feel like you’re struggling to stay on top of your finances then seek advice. There are loads of ways in which you can do so; the internet is a great way of doing so if you’re not confident with speaking face to face regarding your problems. Many debt charities will also have trained agents at the end of the phone who help people like you on a daily basis. Try to avoid public forums, these are generally full of people who simply offer their opinion rather than trained advice.