Today there are many applications that help people to control their financial life. You can get a mobile application that will help you to lead your budget and even control your spending. Also you can easily check your account from the Internet even not going out of your house. So have you already been using such services?

Today there are many applications that help people to control their financial life. You can get a mobile application that will help you to lead your budget and even control your spending. Also you can easily check your account from the Internet even not going out of your house. So have you already been using such services?

The latest statistic shows that many people today use online applications not to miss important dates of repayment they have to make. And I think it is very convenient and useful.

So if you want to check if you benefit from all possible financial applications, you need just to read the following tips:

1. Use mobile applications. Almost all banks today have the option which allows sending you e-mails or other alerts when you have your balance low, or the date of repayment is coming, or you just have some other important news from your bank. So it is very useful to have such a reminder that helps you to control your finance.

2. Control your budget. It is the easiest way today to count your spending using a mobile application; you can also make a list for shopping and prevent unnecessary purchases. So when you set a budget for a month and make a note of every spending you can see where your money goes. Also in such a way you can reduce some spending that you cannot afford.

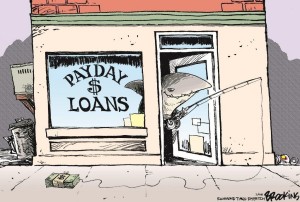

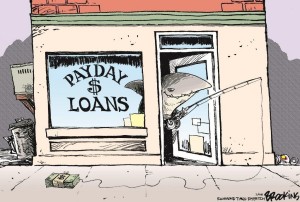

3. Use a debit card. Today it is very comfortable to use a credit card for any purchases in any part of the world. You do not need to have plenty of coins in your pocket to go to the shop. You can just make all purchases and pay for them with your card. Also it allows you to get fast payday loans online from direct lenders when you need quick extra money. You do not even need to go out of your house, because money is transmitted directly on your bank account within 24 hours.

4. Make your payments through the Internet. Once you have tried paying your bills directly from your home, you will never do anything else. That is why you can do all payments and they will be recorded, so you can easily track them. Also this option prevents you from writing checks and waiting till they are cashed.

5. Avoid additional fees. Everyone knows that if you miss the repayment date you will have to pay additional fee and cover some expenses. To avoid this you need to control not only your spending, but also the money you have planned to spend this month. In such case you can avoid fees for the having less money on your account that you are allowed. Also you can make some limited account that will not give you to spend more money than you can.

So, now when you have already learned these rules, you can start dealing with your finance and save some money by preventing additional spending. I hope you understand all advantages of using mobile applications, and will use your mobile phone not only for games and making calls.

There are times when we find ourselves in dire need of cash, but are short of any savings that can come handy. In such situations, all we wish for is some quick cash so that the issue would be solved. One way to ensure such quick cash is the payday loans. These loans are popular for the way they can give immediate cash at a very short notice. There are some specific eligibility criteria that one has to meet in order to qualify for a loan but once they do so, immediate cash availability is no longer a concern.

There are times when we find ourselves in dire need of cash, but are short of any savings that can come handy. In such situations, all we wish for is some quick cash so that the issue would be solved. One way to ensure such quick cash is the payday loans. These loans are popular for the way they can give immediate cash at a very short notice. There are some specific eligibility criteria that one has to meet in order to qualify for a loan but once they do so, immediate cash availability is no longer a concern.

The stringent norms of the traditional lenders are some of the major concerns why people are taking payday loans. At YepNationloansforbadcredit.com, you can find an extensive network of reputable payday loan lenders. These lenders have simple requirements and ask you for some basic information only name, age, employment details and most importantly the borrower’s bank account details.

If you had borrowed money in the past from any financial institution or bank, you would know that the requirements they put forth can be very stringent sometimes, but the case is not so with our payday loans. These no credit check payday loans are short term loans that allow you to have fast cash; hence the documents the lenders ask for are not that detailed and difficult to arrange. Also, this is not just where the advantages of these loans finish; in fact apart from the fact that the documents required to file for this loan are highly simple there is an additional benefit; these loans do not require any pre-loan credit check of the borrower.

So when you look at it the loan is comprehensively meant to provide you with quick cash without too much of a hassle, that you might otherwise have been subjected to if you had gone for any other conventional loan. These loans are extremely easy to apply for, all you will need is a working computer, and you can apply online. If you have gone through our website then you must have noticed we always stress on how fast the service is and how soon we can provide you with urgent money that you need.

There are a large number of lenders on the internet these days that make the claim that they can provide you with money within an hour or even less. However, we warn you to be very careful and check the credibility of these lenders even before you hand over any personal or financial details to them. This is due to the rising cases of internet frauds and identity theft, which can land you into a bigger trouble.

As it is with any loan, in order to get the loan amount sanctioned quickly, you must take care of some things. You must submit the documents and personal details you are asked for, in time and with accuracy. Inaccurate information can eventually lead to the process becoming too sluggish or may even result in your loan request being denied. So, if payday loan is what you need, just log on to the application page and apply for a loan!

Tags: budgeting, debts, economy, interest rates, loans, money, payday loan, personal finance, quick cash

Budgeting, Debts, Financial Planning, Investment, Loan, Personal Finance

Budgeting, Debts, Financial Planning, Investment, Loan, Personal Finance

Setting a financial plan as a framework of your life will help you to avoid many challenges and to enjoy wealthy life. Of course in today’s economic conditions many people face a strongly restricted budget. But still this budgeting will help to avoid such problems as debt, cash shortfalls, collector’s calls, insomnia and depression. There is no doubt that it is better to refuse from making any kinds of spending than to face such terrible problems. Here are 7 steps which will help you to create budget which would become a support for the whole family.

Setting a financial plan as a framework of your life will help you to avoid many challenges and to enjoy wealthy life. Of course in today’s economic conditions many people face a strongly restricted budget. But still this budgeting will help to avoid such problems as debt, cash shortfalls, collector’s calls, insomnia and depression. There is no doubt that it is better to refuse from making any kinds of spending than to face such terrible problems. Here are 7 steps which will help you to create budget which would become a support for the whole family.

1. Contemplate your spending. If you are yet not doing this than it is just the right moment to start recording all your expenses. You need to have a picture of your spending at least for several months. It is urgent to know exactly how much money was spent and what exactly was bought. Classify and regularize your needs so that you could get a few expenditure points.

2. Determine the income sources. When you know how much money is spent to maintain you standard of living cast a glance at your income and compare it to the outcome. Here you will have to take an important decision about whether you need to find a higher paying job or to apply for a spin-off job. Or maybe your jobless wife has to start working.

3. In case of money shortage banks’ help seems to be the most relevant option. But here you need to insight into the essence of the process and to understand when payday loans Canada, online loans, quick loans and also the wide range of credit options can bring real benefit and when it will bring nothing but harm. Be very careful and meticulously calculate the cost of the service and evaluate it against the budget.

4. Once you know how much money you need to spend and how much you earn don’t hurry to search additional income sources in case of money lack. Now you have a chance to think if all of your spending is really necessary. There are plenty of opportunities to cut back on daily expenses and to save money for more relevant goals.

5. Saving money should become philosophy of your life. Emergency fund, retirement fund, money for tuition, money for wedding – this everything should be little by little collected from your each paycheck.

6. Having determined main directions of your spending make every effort not to go over the budget. Moreover life is changeable and you will need to reconsider your budget strategy and to adjust it to the current moment.

7. It is very important to build your budget around goals in your life. Don’t wait until happiness and luck fall on your head from the heaven. Just make best to enjoy all luxuries of this life.

Very often people come across situations during which they need to access quick funds. The main concern is the short term for the loan. Since the difficulty in repaying the loan in a short time is felt, many people look for fast loans with the provision of repayments in installments. These fast loans cannot be accessed by poor credit borrowers. With a good credit score, these loans are easy to obtain. The banks and other financial institutions can be approached for fast loans with monthly repayments.

Very often people come across situations during which they need to access quick funds. The main concern is the short term for the loan. Since the difficulty in repaying the loan in a short time is felt, many people look for fast loans with the provision of repayments in installments. These fast loans cannot be accessed by poor credit borrowers. With a good credit score, these loans are easy to obtain. The banks and other financial institutions can be approached for fast loans with monthly repayments.

Fast loans are secured loans

Most of these offers are personal loans and however, there are loans which are granted for specific purposes like the purchase of autos and so on. Theoretically, any loan can be considered as fast loan allowing monthly payments. But, the fast loan with monthly payments has some basic features. The offer is a secured loan. You can submit your home equity, financial instruments, and valuable jewelry and so on as security for the loan. If the loan is intended for specific purchases such as a vehicle, then the vehicle can be submitted as collateral for the loan.

Committing to monthly installments is a serious issue. The offer is ideal for those with secured employment and regular income. The interest rates are determined based on the credit report of the borrowers. With good credit ratings, you can get eligible for loan with lower interest rates. The fast loan with monthly payments can be beneficial to you only if the interest rates are nominal as the stress due to regular monthly payments is minimized. The term of the loan is around 2 to 5 years and lower in certain cases. The amount you commit to pay every month determines the loan term. The interest rate is lower if the loan term is longer.

Though there are some similar basic features for all fast loans with monthly payments, each of the offers differ in certain factors. To get one of the best offers, you have to approach the loan originator. You can expect to get quick access to a good offer with flexible terms and reasonable interest rates, if your credit score is excellent. The fees for originating the loan, the charges for the process and other fees such as commissions and so on will be affordable if the loan originator is approached for the loan. As you submit the application for the fast loan with monthly payments, the lender reviews your application here.

The lenders check your credit record and other details that are required for the loan approval. The interest rates and repayment details will be intimated to you as soon as your loan application is approved. Evaluation of the collateral that is submitted for securing the loan is done as a part of the loan underwriting process. Your debt to income ratio is scrutinized to ensure that you can afford the loan. With a cleaner credit record, you can enjoy the benefit of lesser fees. Banks and other government financial organizations can be approached for the offer as you can get the loans for lower interest rates than you can get from private lenders.

FHA 203k loan can be borrowed to purchase a home or to improve the home if needed. A clear understanding of the offer is necessary to understand whether you will be benefited by the offer or not. The eligibility criteria and the extra costs for the offer should be understood before you opt for the loan. The interest rates for FHA 203k loan are higher than charged for other types of FHA loans. This makes the borrower pay more for the loan than its real worth. The lenders do not have much risk as there is guarantee for the loan.

FHA 203k loan can be borrowed to purchase a home or to improve the home if needed. A clear understanding of the offer is necessary to understand whether you will be benefited by the offer or not. The eligibility criteria and the extra costs for the offer should be understood before you opt for the loan. The interest rates for FHA 203k loan are higher than charged for other types of FHA loans. This makes the borrower pay more for the loan than its real worth. The lenders do not have much risk as there is guarantee for the loan.

The costs involved in the offer

This all in one mortgage loan is backed by the U.S. Department of Housing and Urban Development and the loan is offered by the mortgage personal loans bad credit lenders. Since the loan is insured by the federal government, the approval does not get delayed. There are closing costs for the loan which you can pay eventually. With the origination charges and the insurance for the loan, the lender is protected though the borrower does not repay the loan as specified in the loan agreement. The charges due to the improvement work should be considered.

The plans of improvement are reviewed by one of the approved consultants of FHA and the approval is granted as per the review. The repair work is also supervised in every stage which increases the cost of the loan. The borrower is required to bear the cost due to the appraisal as well. All these should be considered while you estimate the cost of the loan and your ability to make repayments due. Safety and health issues are to be addressed and they should adhere to the building codes specified.

Electrical problems and lead points are some of the important items that are included in the project list. There are restrictions to the offer and you cannot get approved for the loan if you wish to make some profit out of your investment in the property. You need to be a owner occupying the house to be eligible for FHA 203k loans. The offer cannot be obtained for the purpose of investments. If you decide to make additional structure to your house that you have rented out, you can get the offer of FHA 203k loan.

There is the minimum amount specified for the personal loans no credit check and the borrower is supposed to complete the mentioned renovation or repair work within the set time. The loan is initiated to support in the purchase of a home or to do the renovations that are essential. You cannot think of using the loan amount for luxury items. However, you should also remember that you cannot get the needed loan amount if you underestimate the cost of the renovation work. Besides your financial counselor, it is important to consult a good contractor to get the required financial support from FHA 203k loans.

Today there are many applications that help people to control their financial life. You can get a mobile application that will help you to lead your budget and even control your spending. Also you can easily check your account from the Internet even not going out of your house. So have you already been using such services?

Today there are many applications that help people to control their financial life. You can get a mobile application that will help you to lead your budget and even control your spending. Also you can easily check your account from the Internet even not going out of your house. So have you already been using such services?