Freedom Debt Relief Shares Old-Fashioned Savings Tips That Still Work

It’s true that financial habits change as time passes, but there are some money saving methods that are tried and true. Adopting some of these old-fashioned savings tips recommended by Freedom Debt Relief will help you build your savings account. The money you save can be used to boost your emergency fund, pay off debt, or take your annual vacation without going into debt. With that said, there are a few time-tested savings methods you can adopt.

It’s true that financial habits change as time passes, but there are some money saving methods that are tried and true. Adopting some of these old-fashioned savings tips recommended by Freedom Debt Relief will help you build your savings account. The money you save can be used to boost your emergency fund, pay off debt, or take your annual vacation without going into debt. With that said, there are a few time-tested savings methods you can adopt.

Get rid of marketing messages.

Once you give your contact information to a company, you open up the door for them to send your marketing messages. Companies send millions of dollars and lots of time crafting messages that will convince people to buy. It’s hard to resist the temptation of marketing messages, so opt-out of them completely. If you’re receiving marketing messages, click the unsubscribe button at the bottom of the email to stop receiving those message. That way, you never get hit with an advertisement.

Cut back on eating out.

Eating out at restaurants is enjoyable, but the cost adds up quickly, especially if you’re eating out several times each week. Reducing the number of meals you eat in restaurants will let you save hundreds, possibly even thousands of dollars each year. When you do eat out, don’t let leftovers go to waste. Portion sizes in the United States are large enough that you can take half your meal home and enjoy it for the next day’s lunch or dinner.

Don’t pay for things you can do for yourself.

While it may be more convenient to pay someone to do small repairs or other odd jobs, you’ll save money by doing things yourself. Picking up some basic sewing skills, for example, will allow you to make your own clothing repairs and avoid having to pay a seamstress. Freedom Debt Relief recommends using the internet to learn how to solve some of your basic repairs and save the big jobs for professionals.

Save your change.

A few dimes and nickels here and there doesn’t seem like much, but over the course of weeks and months that little bit of pocket change adds up. Get a separate change jar or bucket where you can collect you change. You might be tempted to dip into it every down and then, but leave it alone. The longer you let you change accumulate, the more you’ll have, says Freedom Debt Relief.

Avoid disposable items.

Let’s face it, many of us like to eliminate as much housework as possible. To accomplish that, we turn to disposable items like paper plates, cups, and cutlery. Not only do these items lead to more environmental waste, they also cause you to spend more money than necessary. It only takes a few minutes each day to do the dishes. Freedom Debt Relief advises families to simply make the sacrifice and avoid throwing money away on disposable items.

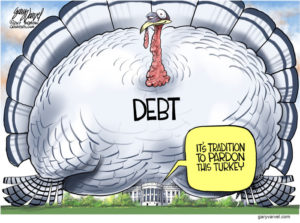

Get rid of debt.

With debt, we can purchase things now and then conveniently pay for them over a period of time. But, there’s a catch. When a lender gives you the option of paying for something in installments, you’re going to pay interest. The more you borrow, the higher your interest rate, and the longer it takes you to pay off the debt, the more you’ll pay in interest. You can potentially save thousands of dollars in interest, says Freedom Debt Relief, just by paying off debt faster. Look for extra money in your budget or find ways to increase your income and use the additional money to reduce your debt faster.

Don’t discount these methods because they seem old-fashioned. You’d be surprised to see just how much impact these savings strategies can make on your savings account.