A Newbies’s Guide To Investing

There is no point in leaving all your cash in your current account. The interest rate will only be fairly low. It is much more advisable to move your money into a better investment that can help it increase. Of course, leave some money in your current account for everyday needs. But all your savings? It’s better off to invest them. If you are a complete novice when it comes to investing, it can be a very daunting prospect as there is a slight risk that you could lose some money. Here is what you need to know before you start.

There is no point in leaving all your cash in your current account. The interest rate will only be fairly low. It is much more advisable to move your money into a better investment that can help it increase. Of course, leave some money in your current account for everyday needs. But all your savings? It’s better off to invest them. If you are a complete novice when it comes to investing, it can be a very daunting prospect as there is a slight risk that you could lose some money. Here is what you need to know before you start.

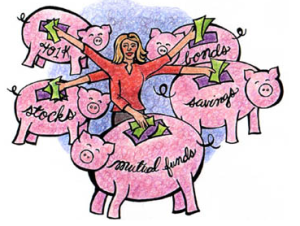

Diversify

One of the big things to remember is the importance of diversifying. This helps you reduce the risks of investing. What does diversifying mean? Simply put, it is when you split up your money and invest in different methods. This is a much safer alternative than placing all your cash in just the one investment. Diversifying reduces the risks of investment. Because you are essentially spreading your eggs across different baskets.

Stocks And Shares

One of the most common ways to invest your money is in stocks and shares. This involves buying some stocks and shares of a company that is floating in the stock market. You will be able to buy as many as you like, although some companies have a minimum purchase limit. Before you commit to buying a company’s shares, you need to do your research. If the company is currently doing well, then there is a good chance the value of your shares will increase, leaving you with a profit. However, if the value falls, you could end up out of pocket. If you do your homework, you can make a lot of money over a long period of time!

Funds

Instead of investing directly in stocks and shares yourself, you can put your money into mutual funds. This is, basically, where you get a professional to invest your money for you. You transfer the money you want to invest to this financial advisor who then places it into a fund, so he can keep an eye on your money on a daily basis. This is known as a mutual fund, and your advisor is now the fund manager. There are a few different types of funds available. For self managed super fund advice, check online.

Savings Account

One of the safest ways to invest money is to place it in a high-interest savings account. There is no risk involved with a savings account, as the amount of money held in there won’t change depending on the economy. It is an easy way to get more money, though. The more money you have in the account, and the higher rate of interest, means you can get a substantial payment from your bank each month.

So, to be clever with your money, sometimes you have to take a risk and invest. If you do your research, you’ll find the benefits far outweigh any potential risks!